Pub. KS-1530 Tire Excise Tax

PDF printable copy is located here.

Kansas tire retailers and new vehicle dealers are required to collect and pay the Kansas Tire Excise Tax. This publication is designed to assist you in understanding which sales are subject to this tax, which ones are exempt, and how to properly collect and remit the tire excise tax to Kansas Department of Revenue. Information about your tax responsibilities, a sample completed return, and blank forms are also included.

As a tire retailer or vehicle dealer accepting waste tires from customers, you are responsible for complying with the provisions of the Kansas Waste Tire Law, discussed on pages 3 and 9 of this publication. To obtain detailed information and assistance with your responsibilities under this environmental law, including the current rules and regulations for the disposal of waste tires, contact the Kansas Department of Health and Environment, Bureau of Waste Management (see page 9).

Table of Contents

- INTRODUCTION

- REGISTRATION AND TAX NUMBERS

- TAX COLLECTION AND KEEPING RECORDS

- KANSAS CUSTOMER SERVICE CENTER

- REPORTING AND PAYING THE TIRE EXCISE TAX

- ADDITIONAL INFORMATION

- FORMS AND CERTIFICATES

- TAXPAYER ASSISTANCE

INTRODUCTION

WHAT IS THE TIRE EXCISE TAX?

Since July 1, 1990, Kansas has imposed a tire excise tax on the retail sale of new vehicle tires. There are two general types of tire sales subject to the tire excise tax: 1) the sale of new vehicle tires by a tire retailer; and, 2) the sale of new tires mounted on a new or used vehicle sold at retail for the first time.

Like Kansas sales tax, the tax is paid by the customer to the tire retailer or vehicle dealer. The retailer will collect it from the final user or consumer, hold it in trust for the state, then remits it to the Kansas Department of Revenue on a regular basis using the TE-36 Tire Excise Tax Return.

RATE OF TAX

The tire excise tax is 25 cents on each new vehicle tire sold on or after July 1, 2001 (tax was 50 cents prior to this date). This excise tax is in addition to any federal tax or the Kansas sales tax due on these retail sales.

WASTE TIRE MANAGEMENT FUND

The revenue generated from the tire excise tax is deposited into the Waste Tire Management Fund. This fund is administered by the Kansas Department of Health and Environment and is used to clean up pre-law (prior to 1990) waste tire sites; provide public education on the proper disposal and processing of used (waste) tires; and, provide administrative funds for permits, planning, compliance, and enforcement of laws regulating the storage, recycling, processing, and disposal of used and waste tires.

WHAT VEHICLE TIRES ARE TAXED?

The tire excise tax is imposed on the retail sale of new vehicle tires within the state of Kansas. A vehicle is any device by which persons or property may be transported or drawn upon a highway, including agricultural implements. This excise tax, therefore, applies to new tires for: automobiles, boat trailers, buses, combines, construction equipment, farm machinery, mopeds, motorcycles, pop-up campers, recreational vehicles, tractors, trailers, trucks, and truck tractors.

The retail sale of new vehicle tires within the state of Kansas means that the sale of the tire(s) took place within the geographical boundaries of Kansas. This includes sales of tires by tire dealers located in Kansas and delivered within the state Kansas. It also includes tires sold by out-of-state dealers who are physically present in Kansas and sell tires at retail within Kansas. No Kansas tire excise tax is due on the sale of tires by a Kansas dealer for delivery outside of Kansas. Likewise no Kansas tire excise tax is due on the sales of tires by an out-of-state dealer who merely delivers or ships the tires into the state of Kansas.

Vehicle does not include devices powered by humans (i.e., bicycles) or those not authorized to operate on public highways (i.e., ATVs, golf carts or riding lawn mowers).

TAXABLE TIRE SALES

Following are examples of tire sales subject to the tire excise tax.

- New tires sold to the final user or consumer, including, but not limited to, new tires sold to individuals and corporation, farmers and ranchers, and entities exempt from Kansas sales tax.

- New tires mounted on new and used vehicles

- New tires installed on vehicles in Kansas even though the buyer is a resident of another state.

- New tires sold to a vehicle, implement, or equipment dealer for installation on a used vehicle being held for resale – unless dealer provides a Tire Retailer Exemption Certificate.

- New tires sold for a truck mounted with a spreader or mixer-feed truck used to dispense feed in a feedlot.

- Tires sold to persons in the business of leasing and renting vehicles, including vehicles leased to interstate common carriers.

CAUTION: The tire excise tax is separate from Kansas sales tax. Tire sales that are exempt from Kansas sales tax may be subject to tire excise tax.

EXAMPLE: New or used farm machinery and equipment, repair, and replacement parts (including new tires) are exempt from sales tax by law. However, when new tires for a combine are purchased, the tire excise tax is due. The new tires on a new combine are also subject to the tire excise tax

Other tire sales exempt from Kansas retailers’ sales tax but subject to the tire excise tax include new tires sold to: interstate common carriers; the state of Kansas; Kansas political subdivisions (cities, counties, police departments, etc.); public or private elementary and secondary schools and other educational institutions; nonprofit hospitals; and, nonprofit 501(c)3 museums, religious organizations, and zoos. These buyers must pay the tire excise tax on their direct purchases* of new tires.

* A direct purchase is one that is invoiced to the exempt buyer and is paid by check, warrant or voucher from the exempt buyer.

TIRE SALES NOT SUBJECT TO TIRE EXCISE TAX

The tire excise tax does not apply to these tire sales.

- Used, recapped, or retreaded tires.

- A spare tire included in the sale of a new vehicle.

- Innertubes.

- New tires for vehicles not authorized or allowed to operate on public streets and highways, such as garden tractors, ATVs and wheelbarrows.

- New tires for vehicles powered by humans, such as bicycles and tricycles.

- New tires for mobile or manufactured homes.

- New tires sold to the federal government (also exempt from sales tax if a direct purchase).

- New tires delivered by the retailer to a point outside of Kansas or delivered to an interstate common carrier for transportation to a point outside the state. (These out-of-state sales must be documented in the seller’s records by invoice or bill of lading showing an out-of-state address.)

- New tires sold by one registered tire retailer to another registered tire retailer. ST-28T The Tire Retailer Exemption Certificate on page 15 must be completed and kept by the seller for the exemption to be valid.

REGISTRATION AND TAX NUMBERS

WHO MUST REGISTER?

A retailer is a sole proprietorship, partnership, limited liability company or corporation selling tangible personal property to the final user or consumer (retail sale). Tires and vehicles are tangible personal property. Kansas retailers must be registered to collect Kansas retailers’ sales tax on their sales of tangible personal property. For more information about the types of sales and services that are taxed in Kansas obtain Pub. KS-1510, Kansas Sales and Compensating Use Tax, from our website (ksrevenue.gov).

If you sell new vehicle tires you must register with the Department of Revenue to collect the tire excise tax. Since this tax also applies to new tires on a new vehicle sold for the first time, dealers must also register to collect and remit the tire excise tax. This includes retailers or dealers of new boats, cars, combines, construction equipment, farm tractors, hay balers, motorcycles, plows, recreational vehicles, semi-trailers, trailers, trucks, truck-tractors, or any other type of vehicle.

HOW TO REGISTER?

To apply for a tax number or to register for Kansas Retailers’ Sales Tax, visit ksrevenue.org and sign in to the KDOR Customer Service Center. After you complete the application you will receive a confirmation number for your registration and account number(s). If you have questions or want to apply in person, the Taxpayer Assistance Center is open by appointment only. Go to ksrevenue.gov to set up an appointment at the Topeka or Overland Park office by using the Appointment Scheduler.

TIRE EXCISE ACCOUNT NUMBERS

Once your application is processed, your business is assigned a sales tax account number. Your sales tax account number has three distinct parts:

- Tax Type: Each tax type administered by the Departmentof Revenue has been assigned a number. The “016” is the number assigned to Tire Excise Tax and appears on your registration certificate.

-

Account Number = EIN (Employer IdentificationNumber): The number is your federal EIN, followed by the letter “F.” The nine-digit EIN is issued by the Internal Revenue Service to identify employers and businesses.

If you are not required to have an EIN, the Department of Revenue will create an account number for you. These account numbers begin with a “K” (or an “A” if registering online with the Kansas Business Center) followed by eight numbers and the “F.”

- Numerical Suffix: The two-digit code at the end of thenumber is for Department of Revenue use. Generally it is “01” and denotes either the number of locations or the number of registrations under this EIN, “K”, or “A” number.

YOUR REGISTRATION CERTIFICATE

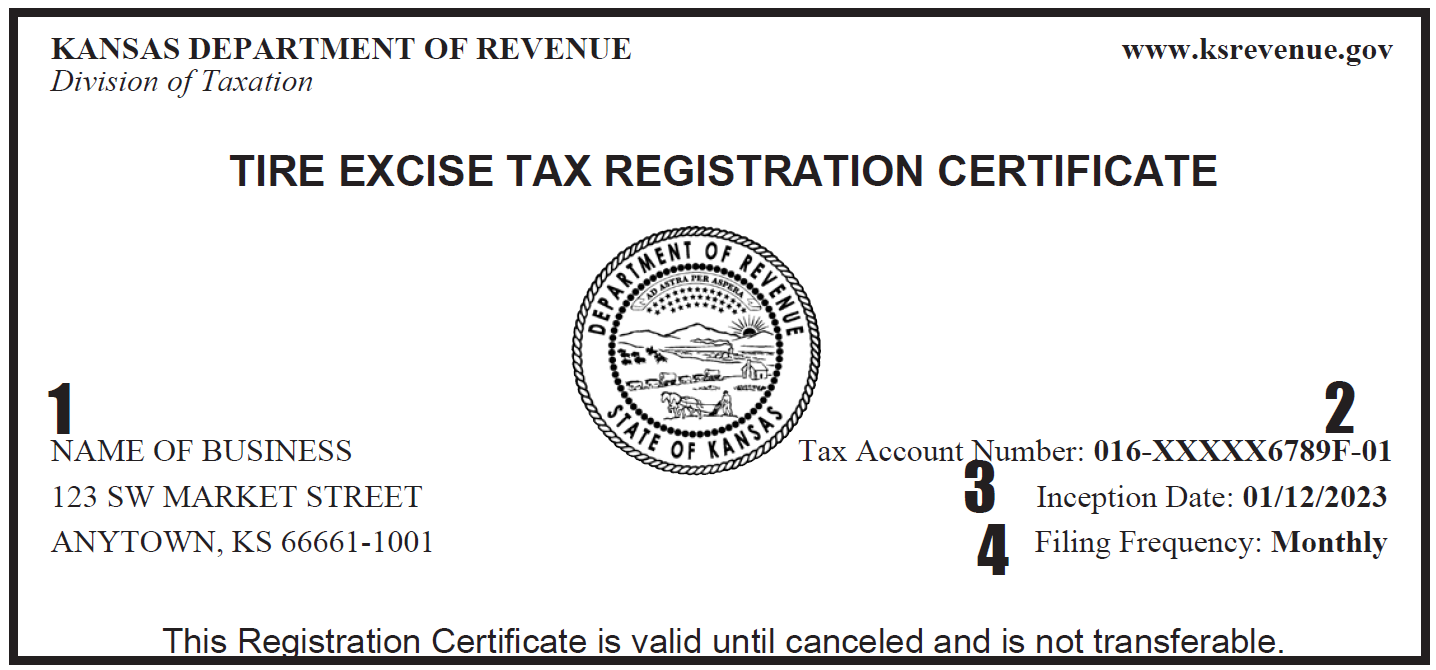

After a tax account number has been assigned, a tire excise tax registration certificate is issued to you. When you receive it, check it for accuracy and report any corrections to the Department of Revenue immediately. The following is a sample sales tax registration certificate.

- Business Name and Address: Name and physicallocation for this registration number. If you do not have a fixed business location, your mailing address is used.

- Tax Account Number: The tax-type and your EIN or “K” or “A” number assigned by the Kansas Department of Revenue to record your account information. This number is partially “masked” to safeguard your EIN from public view.

- Inception Date: Date retail sales began at this location or anticipated starting date as indicated on your business tax application.

- Filing Frequency: How often you are required to file your Kansas sales tax returns. Your filing frequency is determined by the amount of sales tax collected in a year using the chart on page 15.

How to Display and Use Your Certificate

Your registration certificate must be displayed in a “conspicuous location” in your business to let your customers know you are duly registered to collect and remit the taxes you are charging them. Many businesses place it in a display case or frame near their cash register. If you are registered for more than one tax, display them together. You must have a registration certificate at all times. If it is lost or destroyed, request a duplicate from the Department of Revenue.

You may copy the certificate. Many suppliers will request a copy of your registration to verify your tire excise tax number on an exemption certificate.

TAX COLLECTION AND KEEPING RECORDS

INVOICING THE TAX

The tire excise tax must be separately stated on the invoice, bill of sale, or sales receipt. If it is not separately stated, the tire excise tax amount becomes part of the gross sales price and will also be subject to sales tax. These examples show the proper way to invoice the retailers’ sales and tire excise tax on a retail sale.

New Tire Sales

Two new tires $150.00

Less Sale discount 30.00

Net cost $120.00

Mounting labor 16.00

Tire disposal fee 3.00

Net taxable $139.00

6.5% Sales Tax 9.04

Tire Excise Tax (25 cents per tire) .50

Total due $148.54

Labor charges to mount the tire and other fees you may charge for disposal of tires or filters and other environmental charges are subject to the Kansas retailers’ sales tax because they are a part of the gross selling price of the tire.

New Vehicle Sales

New vehicle $17,800.00

Less trade-in _4,500.00

Net taxable $13,300.00

6.5% Sales Tax 864.50

Tire Excise Tax (25 cents per tire) 1.00

Total due $14,165.50

The tire excise tax is due on the four new tires and is not due on a spare tire included in the sale of a new vehicle.

Local Sales Tax. The sales illustrated above are also subject to any local (county or city) retailers’ sales taxes in effect at the location of the retailer. Only the state sales tax rate of 6.5% is shown in these illustrations.

EXEMPTION CERTIFICATES

An exemption certificate document shows why sales tax was not collected on an otherwise taxable sale. The exemption certificate you will use to purchase your inventory of new tires for resale is the ST-28T Tire Retailer Exemption Certificate on page 12. It acts as a resale exemption certificate for Kansas sales tax purposes as well as an exemption from the tire excise tax.

As a registered retailer, collecting Kansas retailers’ sales tax, you should have our Pub. KS-1520 Kansas Exemption Certificates that is available on our website. Taxpayers who are exempt from sales tax must provide you, the retailer, with a completed sales tax exemption certificate to verify that the sale is exempt from sales tax.

CAUTION: Regardless of the buyer, most new tire sales and new vehicle sales are subject to the tire excise tax. Only the federal government is exempt from paying either tax on its direct purchases of new tires or new vehicles.

TIRE EXCISE TAX RECORDS

Like any part of your business operation, complete and accurate records of tire and vehicle sales must be kept for at least three prior years. For Kansas tire excise tax purposes, your records should have the following information and documents.

- All invoices of new tire sales and/or sales of new or used vehicles.

- All exempt sales allowed by law.

- All exemption certificates.

- A true, complete inventory taken at least once a year.

Your records of retail sales and tire excise tax must be available for, and are subject to, inspection by the Director of Taxation (or authorized representative).

KANSAS CUSTOMER SERVICE CENTER

FILE, PAY and MAKE UPDATES ELECTRONICALLY

Most businesses have chosen the KDOR Customer Service Center (KCSC) for their online filing and payment solution. To use this solution, you simply create a user login ID and select a password, then you can attach your business tax accounts. Each tax account has a unique access code that only needs to be entered once. This access code binds your account to your login ID. For future filings, you simply log into your account using your self-selected user login and password. A history of all filed returns and/or payments made is retained in the KCSC.

WHAT CAN I DO ELECTRONICALLY?

- Register to collect, file and pay taxes and fees

- Add new locations

- Complete and submit a Power of Attorney form

- Update contact information

- Update mailing address

- Upload W-2’s and 1099’s

- Upload and retain Sales and Compensating Use Tax jurisdictions

- File the following tax returns:

- Clean Drinking Water Fee

- Consumers’ Compensating Use Tax

- Consumable Material

- Dry Cleaning

- Liquor Drink and Liquor Enforcement Tax

- Retail Water Protection

- Retailers’ Compensating Use Tax

- Retailers’ Sales Tax

- Tire Excise Tax

- Transient Guest Tax

- Vehicle Rental Tax

- Make payments for the following taxes:

- ABC Taxes and Fees

- Charitable Gaming

- Cigarette Tax Stamp Payment

- Cigarette Tax, Fees, Fines and Bonds

- Cigarette/Tobacco Fine Payment

- Cigarette/Tobacco License Fee

- Clean Drinking Water Fee

- Consumable Materials Return/Tax Payment

- Corporate Income Tax

- Corporate Estimated Income

- Dry Cleaning

- Fiduciary Income Tax

- Homestead Claim

- IFTA

- Individual Estimated Income

- Individual Income Tax

- Industrial Water

- Liquor Drink and Liquor Enforcement

- Mineral Tax

- Motor Fuel

- Petition for Abatement Service Fee

- Privilege Tax

- Privilege Estimated Tax

- Retail Water Protection

- Sales and Use Tax

- Stock Water

- Tire Excise Tax

- Tobacco Return/Tax Payment

- Tobacco Tax, Fees, Fines and Bonds

- Transient Guest Tax

- Vehicle Rental Excise Tax

- Withholding Tax

REQUIREMENTS TO FILE and PAY

You must have the following in order to file and pay your taxes online:

- Internet Access

- Access Code(s) by calling 785-368-8222 or send an email to kdor_businesstaxeservice@ks.gov

- EIN

- ACH Debit: Kansas Department of Revenue debits the tax payment from your bank account

- ACH Credit: Complete an EF-101 online to initiate a tax payment through your bank

Electronic tax payments must settle on or before the due date. Using the KCSC, you may have your tax payment electronically debited from your bank account (ACH Debit) or you may initiate your tax payment through your bank (ACH Credit). This payment method requires a completed authorization EF-101, available on our Kansas Customer Service Center.

Our FREE electronic systems are simple, safe, and conveniently available 24 hours a day, 7 days a week. You will receive immediate confirmation that your return is filed and/or payment is received. If you need assistance with your access code, you may call 785-368-8222 or email kdor_businesstaxeservice@ks.gov

PAY BY CREDIT CARD

Payment by credit card is available online through third-party vendors. Visit our Electronic Services website at https://www.ksrevenue.gov/taxpayment.html for a current list of vendors authorized to accept individual income tax and business tax payments for Kansas. A convenience fee, based on the amount of tax you are paying, will be charged.

WIRE TRANSFERS

Wire Transfers are accepted from both domestic and foreign banking institutions as long as it is received as American currency. For more information call 785-368-8222.

REPORTING AND PAYING TIRE EXCISE TAX

FILING FREQUENCIES AND DUE DATES

How often you report and pay the Kansas tire excise tax you have collected depends on the amount of tire excise tax collected in a calendar year. The larger the annual tax amount, the more frequently returns are required. Kansas has three tire excise tax filing frequencies – annual, quarterly, and monthly.

Your filing frequency is established when you register, based upon the estimate you gave on the business tax application. The filing frequency established for your tire excise tax may be different than your sales tax. For example, a new car dealer may report sales tax on a monthly basis and the tire excise tax on a quarterly basis.

Like sales tax, the tire excise tax is due on or before the 25th of the month following the close of the reporting period. The following chart shows the filing frequencies based on annual tax liability and due dates of tire excise tax returns:

| Annual Tax Due | Filing Frequency | Return Due Date |

|---|---|---|

| $0—$80 | Annual | On or before January 25 of the following year. |

| $80.01—$1,600 | Quarterly | On or before the 25 of the month following the end of the calendar quarter— April 25, July 25, October 25, January 25. |

| $1,600.01 and over | Monthly | On or before the 25 of the following month (e.g., a March return is due by April 25). |

TIRE EXCISE TAX RETURN — FORM TE-36

Access our Customer Service Center to file and pay your Tire Excise Tax (TE-36). See example of TE-36 on page 11.

YOUR REMITTANCE

To help ensure proper credit to your tire excise tax account, use the following check list before mailing your return and payment to the Kansas Department of Revenue.

- Make your remittance payable to “Kansas Tire Excise Tax.” DO NOT SEND CASH.

- Write your Tire Excise Tax number and the filing period on your check or money order.

- DO NOT staple the return and payment together. Instead, enclose them loosely in the envelope.

AVOIDING COMMON MISTAKES

Identify each payment. Always mail a return, form TE-36, with your payment. Write your Kansas Tire Excise Tax account number and filing period on your payment.

Use the proper return. Each pre-printed return is encoded for processing purposes – do not change the printed information on the return. If the information on your return is incorrect or if you do not have a pre-printed return, obtain a blank return from our office or website for filing. See Taxpayer Assistance.

File a return for each reporting period. If your filing frequency is monthly, you must file a return for each of the 12 calendar months, even if you have no new tire sales or tire excise tax to report. If you have no tax to report in any given reporting period, simply enter “0” on lines 1 and 5 of the return, sign, and mail it to the Department of Revenue.

File returns on the established filing frequency. Do not file your Kansas tire excise tax returns either more or less frequently than your current established filing frequency.

CORRECTING A RETURN

As provided by K.S.A 79-3609(b) no refund or credit shall be allowed by the director for a return filed more than three years from the due date of the return for the reporting period.

If you discover you made an error on a return, you can correct it by filing an amended return. Generally, you have three years from the date you filed the original return to file an amended return for that period. The following are some common errors to correct by filing an amended return.

- Tax was included in the gross sales figure used tocalculate your tax liability.

- Mistakes in accounting caused an error in reporting thegross sales or taxable purchases for a period.

- Tax was charged on items in error, or deductions fornontaxable and exempt items were not taken.

Amending Electronically

To correct errors on previously-filed returns, file an amended return for each affected period. To amend a return using the electronic application, select the amended (or additional) return option rather than the original return option. When you are filing an amended return, you will be asked to enter the total amount previously paid for the filing period as a credit.

Amended vs. Additional Returns

In addition to amending returns, retailers have the option to file an additional return for any filing period. An additional return adds to what has already been reported on the original return. For example, if a retailer files an “original” return reporting $100 and then files an additional return for the same reporting period for $50, the Department of Revenue will understand the total tax for the period to be $150.

An amended return erases everything that was reported on the original return and substitutes the new information contained on the amended return. For example, if a retailer files an amended return reporting $50, when $100 was reported on the original return, then the Department of Revenue will understand the total tax for the period to be $50.

Once you have completed the corrected returns, you will have either an overpayment (credit) or an underpayment (additional tax is due).

Underpayments

Payment of any additional tax shown on an amended return must be made when the return is filed. Late charges are added to any underpayment after the original due date, according to the penalty and interest rules outlined herein.

Overpayments

Overpayments will be reviewed and a Credit Memorandum may be issued for the amount of any verified overpayment. Note: Credit will first be applied to any existing balances.

WHEN RETURNS ARE LATE

The Kansas tire excise and retailers’ sales tax are often referred to as trust fund taxes. As a registered retailer, you collect these taxes from your customers, hold them in trust, and then remit them to the Department of Revenue. These consumer-paid taxes are not an expense of your business. However, when the returns are late, the late charges are a business debt that decreases your profit margin.

Penalty

Penalty on a late tire excise tax payment is computed at the rate of 10% on the amount of tax due if the payment is received after the due date but within 60 days of the original due date. Penalty is computed at 25% on the balance due if the payment is received after 60 days of the original due date.

EXAMPLE: A January 2023 tire excise tax return (due February 25, 2023) upon which $400 tax is due, is not paid until April 25, 2023. The penalty is 10% of the unpaid tax or $40. If the same return is not paid until May 25, 2023, the penalty is 25% of the unpaid tax or $100.

CAUTION: A penalty of 50% may be assessed when, with fraudulent intent, a taxpayer fails to pay any tax, or make, render or sign any return, or to supply any information within the time required by law.

Interest

In addition to the late penalty, interest is charged for eachmonth, or fraction thereof, that the return is not filed or the tax is not paid. Since 1998 the annual percentage rate (APR) for interest has been tied to a federal underpayment rate, and is therefore subject to change each calendar year. Interest rates can be found on our website: ksrevenue.gov. When filing on the KCSC, penalty and interest rates will automatically be calculated.

EXAMPLE: The interest on a January 2023 tire excise tax return of $400 not paid until July 28, 2023 is calculated as follows: Six months x 2023 interest rate of .5% per month x $400 tax due = interest due of $12.

Returned Check Fee

A fee of $30 (plus postage costs for a registered letter) is charged on all returned checks. This fee is in addition to any other penalty or interest.

Waiver of Penalty

If your return is late due to an event beyond your control, you may request a waiver of the penalty. You will need to write a letter giving the specific circumstance(s) that caused the delinquency and request that the penalty be abated. Be sure to include in your letter your tax account number, the filing period, and a telephone number where you may be reached during normal business hours. Send your request with the billing that you received for the late charges.

About our Billing Process

If you file a late return without paying the late charges, or fail to file a return for a required filing period, you will receive a notice from the Department of Revenue. Respond immediately to avoid problems and additional correspondence. Follow the instructions on the statement, which may include returning a copy of the notice to the department with your return(s) and payment for the balance due. If you had already paid the balance and/or filed the missing return(s), use the reply section of the notice to report it so we may update our records.

NON-COMPLIANCE PENALTIES

Fraud

The law imposes fines of up to $1,000, imprisonment, and penalties on any taxpayer who with fraudulent intent fails to file or pay the tire excise tax or who signs a fraudulent return.

Bond

Any taxpayer who fails to pay the tire tax for more than one filing period may be required to post a sum of money as a bond to secure against non-payment of the tax. The bond amount is set by the Kansas Department of Revenue and may be up to a maximum of six months estimated tire excise tax liability.

Retailer and Corporate Officer Liability

Every Kansas tire retailer and/or vehicle retailer is liable to the state for payment of retailers’ sales and tire excise tax collected from the final consumer. Officers and directors of a corporation, such as sole proprietors and partners, are personally liable for all Kansas retailers’ sales and tire excise tax, penalties, and/or interest due during the period they hold office. Thus, if a corporation fails to remit the tax collected from the final consumer, each officer, director, or other responsible party may be held personally liable for these corporate debts.

REPORTING BUSINESS CHANGES

When changes occur in your business, promptly notify the Department of Revenue (see Taxpayer Assistance on the back cover). For faster service, please have your tax account number available when calling our office.

Business Name and/or Address Change

You may report business name or address changes to us by mail or fax, using company letterhead or by completing our DO-5 Name or Address Change. This form is available on our website.

Change of Business Location

When you move your business from one local taxing jurisdiction to another, the Department of Revenue must adjust its records so that the tax is credited to the appropriate county and/or city. Include, in your correspondence, the following information about your new business location.

- Exact physical address and zip code

- City and county if the new location is inside the city limitsof an incorporated city

- Effective date of relocation

Adding a Business Location

When you are expanding your business by adding location(s), you need not complete a new Business Tax Application. Instead, complete a CR-17 Registration Schedule for Additional Business Locations, to register each additional location. This form is available from our website. You will report all sales for the new or additional location(s) under your current tire excise tax account number when filing your TE-36 form type.

Change of Partners

If less than 50% of the ownership (measured by interests in capital and profits) of a partnership changes, complete an CR-18 Ownership Change, available on our website. As an alternative, you may mail or fax a new list of partners to our office. Include the full name, address, telephone and Social Security number of each partner, the tax account numbers and the effective date of the change.

A partnership must apply for a new registration when 50% or more of the ownership changes hands within a 12-month period, or the partnership is dissolved and a new one is started. See instructions that follow.

Change of Business Ownership

When the ownership of the business changes, a new registration is usually required. The following examples of ownership change requires new registration.

- An individual ownership to a partnership or corporation.

- Partnership to a corporation or sole proprietorship.

- One corporation to another corporation.

- Any change in corporate structure that requires a newcharter, certificate of authority, or new EIN.

If you must apply for a new registration number, you will also need to cancel your old registration.

Canceling Your Registration

You must cancel your Kansas tire excise tax registration if you sell or close the business or change the ownership structure of the business. To cancel your registration, complete the Discontinuation of Business section at the bottom of your registration certificate and send it to the Department of Revenue by mail or fax (see Taxpayer Assistance on the back cover).

Change of Corporate Officers or Directors

When there is a change in your corporate officers or directors, complete and return the CR-18 Ownership Change, and also provide the name(s) and title(s) of the resigning officer(s) or director(s). If you prefer you may mail or fax us a letter on your corporate letterhead listing the name, title, home address and Social Security number of each new corporate officer or director, the name and title of each officer or director resigning, and the effective date of the change. A copy of the corporate minutes is also helpful, but is not required.

OTHER KANSAS TAXES

As a retailer in the automotive industry and a Kansas business, you have other tax obligations to the Department of Revenue in addition to the Tire Excise Tax. A short summary of each type of tax follows. Use the CR-16 Business Tax Application to register to collect and/or pay these taxes. For more information see How to Register, herein.

Retailers’ Sales Tax

Kansas imposes a 6.5% state retailers’ sales tax plus local taxes on the retail sale, rental or lease of tangible personal property; labor services to install, apply, repair, service, alter, or maintain tangible personal property; and admissions to entertainment, amusement, or recreation places in Kansas.

A retail sale is an exchange of tangible personal property (goods, wares, merchandise, products and commodities) for money or some other consideration to the final user or consumer. Examples of taxable services include auto repair; commercial wallpapering, painting, and remodeling; washing and waxing of vehicles; and pet grooming.

Local Sales Tax

Kansas cities and counties may also levy a local sales tax ranging from .05% to 3%. Each retailer reports and remits the total of the state and local retailers’ sales tax collected to the Kansas Department of Revenue. See Pub. KS-1700, Sales Tax Jurisdictions for a listing of the current combined state and local rates for each of the incorporated cities, counties, and special jurisdiction areas in Kansas.

Consumers’ Compensating Use Tax

This Use tax is due on property purchased from another state that will be used, stored or consumed in Kansas; and on which a sales tax equal to the sales tax rate in effect where the item will be used, stored, or consumed has not already been paid. Individuals and businesses who purchase goods from a retailer in another state, bring them into Kansas or have them shipped into Kansas for their consumption, use or storage (not resale), must pay Kansas use tax equal to the Kansas sales tax rate in effect where the item will be used, stored or consumed. If the state and local sales tax paid in another state is less than the total tax rate at Kansas buyer’s location, only the difference is due to Kansas.

Corporate Income Tax

This tax is imposed on the taxable income of every corporation doing business within or deriving income from sources in Kansas. The current “normal” tax rate is 4 percent of the Kansas taxable income of a corporation with a “surtax” of 3 percent for tax years 2011 and thereafter, on Kansas taxable income over $50,000.

Motor Fuel Tax

This tax is imposed on the use, sale or delivery of motor vehicle fuels (gasoline & gasohol) or special fuels (diesel & alcohol) in this state. Tax revenues are used to defray the cost of constructing Kansas highways.

The motor fuel tax is remitted to the Kansas Department of Revenue by the distributor of the fuel; however, the tax is included in the price of every gallon of gasoline or diesel that consumers purchase at the pump. There is no motor fuel tax on dyed diesel fuel used only for non-highway purposes. The current tax on motor vehicle fuels is 24 cents per gallon; on special fuels it is 26 cents per gallon, on LP-gas it is 23 cents per gallon and on E85 it is 17 cents per gallon.

Vehicle Rental Excise Tax

When a vehicle is leased or rented for 28 consecutive days or less, a vehicle rental excise tax of 3.5% is charged. This tax is in addition to the sales tax due on these transactions. Car rental agencies, vehicle dealers, repair shops, and others who rent cars must register to collect this tax.

Withholding Tax

This tax is deducted by employers from wages paid to employees to prepay the employee’s income tax liability. Kansas withholding tax is also required on certain taxable non-wage payments by payors, on management and consulting fees paid to nonresidents, and on the Kansas taxable income of the nonresident owners of partnerships, S corporations and limited liability companies. In addition to being registered with the Department of Revenue, employers must register with the Kansas Department of Labor and the Internal Revenue Service.

Because of differences in the computation of the federal and Kansas income taxes, it is not uncommon for a taxpayer to receive a federal income tax refund while owing taxes to Kansas or vice versa. For this reason, the Kansas Department of Revenue has made available form K-4 to be completed along with the federal W-4 form.

For more information about this tax type, including the withholding tax tables, obtain a copy of our Pub. KW-100 Withholding Tax Guide from our website.

KANSAS WASTE TIRE LAW

If your business generates or collects waste tires, you may also have specific responsibilities under the Kansas Waste Tire law administered by the Kansas Department of Health and Environment (KDHE). In addition to setting up the tire excise tax in 1990, the Kansas legislature established laws for tire retailers in order to deal with the storage and disposal of waste tires in an environmentally safe manner.

Not all tire businesses are subject to this law. Some businesses, such as new car dealers, may collect the tire excise tax, but do not meet the definition of a tire retailer. A tire retailer is defined as a person in the business of selling new or used replacement tires at retail. If your business does not sell new or used replacement tires, simply disregard this section.

IMPORTANT: Under the Kansas Waste Tire Law tire retailers are required to: 1) prominently display or make available to customers educational materials provided by the Kansas Department of Health and Environment and the Department of Revenue relating to proper waste tire management practices; 2) accept waste tires from customers when they purchase new tires; and 3) meet waste tire storage and disposal standards.

Waste Tire Disposal Requirements

Tire retailers should only arrange to dispose of their waste tires with persons holding a permit from the Kansas Department of Health and Environment. Responsibility for the waste tires generated by a business is released only when waste tires are given to a permitted transporter, processor, or solid waste facility. Tire retailers may contract with a waste tire transporter or deliver their waste tires directly to a tire disposal or solid waste facility permitted by the Kansas Department of Health and Environment. A list of current waste tire permit holders is available online from the Kansas Department of Health and Environment at the website shown below.

Waste tires may be given to non permitted parties for approved beneficial uses such as silo covers and feed bunks. However, if someone without a waste tire permit hauls away the tires, the tire retailer could be required to pay for clean up if they are illegally dumped. It is in the best interest of every tire retailer to check the permit list and require copies of current permits from any contractor removing waste tires from its business. Tire retailers must maintain records of tire disposal for three years.

For more information about your responsibilities under environmental laws and regulations for disposal of waste tires contact:

Kansas Department of Health and Environment

Bureau of Waste Management

Phone: 785-296-1600

FAX: 785-296-8909

kdhe.state.ks.gov/168/waste

ADDITIONAL INFORMATION

TAX ASSISTANCE

This publication is for informational purposes only; the contents should not be used to set or sustain a technical position. Only the law, regulations, and written rulings issued by the Kansas Department of Revenue should be used to support a legal position. The law governing the Kansas Tire Excise Tax and Waste Tire Law is K.S.A. 65-3424 et seq. When there is a question not answered in this publication, contact the Department of Revenue. Do not guess. Clarification of whether a transaction is taxable or exempt will save you time in dealing with the same issue in the future and could also save you money by avoiding costly retailers’ sales or tire excise tax deficiencies.

Many business questions can be answered by the customer representatives in our Tax Assistance Center in Topeka. However, like many businesses, the Department of Revenue uses an automated answering system to direct incoming phone calls to the appropriate area. See back cover for the address and phone numbers of our assistance center.

WEBSITE — ksrevenue.gov

Our website contains information about all aspects of the Kansas Department of Revenue. Forms and publications, exemption certificates, and information about all the taxes administered are published here. Each division of the Department of Revenue is represented. Additionally, our website contains current information devoted to paperless file and pay options.

Written Rulings

At times there are unique situations that may require an interpretation or clarification based upon the law, regulations, and specific facts of the case. To assist you in understanding how the law applies to your business, the Department of Revenue issues three types of written advice: revenue notices, revenue rulings, and private letter rulings. This written advice is binding on the Department of Revenue and may be relied upon as long as the statute or regulation on which they are based is not altered by the Legislature, changed by a court decision, or the ruling itself modified or rescinded by the Department of Revenue.

You should not rely on a verbal opinion from the Department of Revenue regarding taxability not specifically addressed in the law. When an issue arises in your business that is not directly addressed in the law, document the problem in writing and request a Private Letter Ruling or an Opinion Letter from the Department of Revenue. Fax or mail your request for a written ruling to:

Tax Policy Group

Kansas Department of Revenue

PO Box 3506

Topeka, KS 66601-3506

Fax: 785-296-7928

You will receive a written ruling within 30 days after your request (and any additional information necessary for the ruling) is received. Private letter rulings are published in our Policy Information Library (PIL), but the letters have been “scrubbed” to protect the privacy of the taxpayer—any information identifying the taxpayer, such as name, address, product, etc., is blanked out.

FORMS AND CERTIFICATES

An exemption certificate document shows why sales tax was not collected on an otherwise taxable sale. The exemption certificate you will use to purchase your inventory of new tires for resale is the ST-28T Tire Retailer Exemption Certificate on page 15. It acts as a resale exemption certificate for Kansas sales tax purposes as well as an exemption from the tire excise tax.

As a registered retailer, collecting Kansas retailers’ sales tax, you should have our publication on Kansas exemption certificates (Pub. KS-1520) that is available on our website. Taxpayers who are exempt from sales tax must provide you, the retailer, with a completed sales tax exemption certificate to verify that the sale is exempt from sales tax.

CAUTION: Regardless of the buyer, most new tire sales and new vehicle sales are subject to the tire excise tax. Only the federal government is exempt from paying either tax on its direct purchases of new tires or new vehicles.

You may reproduce any form in this publication, unless otherwise marked, as needed or download the certificates from our website at ksrevenue.gov

TAXPAYER ASSISTANCE

This publication is a general guide and will not address every situation. If you have questions or need additional information, please contact taxpayer assistance at the Kansas Department of Revenue.

Taxpayer Assistance Center

PO Box 3506

Topeka, KS 66625-3506

Phone: 785-368-8222

By Appointment - Go to ksrevenue.gov to set up an appointment at the Topeka or Overland Park office by using the Appointment Scheduler.

Office hours are 8 a.m. to 4:45 p.m., Monday through Friday.

PUBLICATIONS

Below is a list of publications available on the Kansas Department of Revenue’s website. These publications contain instructions applicable to specific business industries and general information for all business owners.

- Publication KS-1216, Kansas Business Tax Application

- Publication KS-1510, Kansas Sales Tax and Compensating Use Tax

- Publication KS-1515, Kansas Tax Calendar of Due Dates

- Publication KS-1520, Kansas Exemption Certificates

- Publication KS-1525, Kansas Sales and Use Tax for Contractors, Subcontractors and Repairmen

- Publication KS-1526, Kansas Business Taxes for Motor Vehicle Transactions

- Publication KS-1527, Kansas Business Taxes for Political Subdivisions

- Publication KS-1530, Kansas Tire Excise Tax

- Publication KS-1540, Kansas Business Taxes for Hotels, Motels and Restaurants

- Publication KS-1550, Kansas Business Taxes for Agricultural Industries

- Publication KS-1560, Kansas Business Taxes for Schools and Educational Institutions

- Publication KS-1700, Kansas Sales & Use Tax Jurisdiction Code Booklet

- KW-100, Kansas Withholding Tax Guide

STATE SMALL BUSINESS WORKSHOPS

As part of our commitment to provide tax assistance to the business community, Tax Specialists within the Kansas Department of Revenue conduct small business workshops on Kansas taxes at various locations throughout Kansas. Whether you are a new business owner, an existing business owner, or an accountant, these workshops will give you the tools and understanding necessary to make Kansas taxes easier and less time consuming for you. Topics covered include filing and reporting requirements and methods, what is taxable, what is exempt and how to work with the department in collecting and remitting Kansas taxes.

For a schedule of our workshops, visit our website. Pre-registration is required and a fee may be charged by the sponsoring Small Business Development Center (SBDC).