Pub. KS-1510 Sales Tax and Compensating Use Tax

PDF printable copy is located here (Rev. 11/24).

Welcome to the Kansas business community! This publication has been prepared by the Kansas Department of Revenue (KDOR) to assist you in understanding how the Kansas sales and use tax applies to your business operation. Inside you will find information on what is taxable, what is exempt, how to collect, report, and pay your sales and use tax electronically, and other information of general interest to businesses. Our goal is to make collecting and paying these taxes as easy as possible and to help you avoid costly sales or use tax deficiencies.

By law, businesses are now required to submit their Sales, Compensating Use and Withholding Tax returns electronically. Kansas offers several electronic file and pay solutions – see page 16. For the most up-to-date electronic information, visit our website.

TABLE OF CONTENTS

- KANSAS SALES TAX

- SALES THAT ARE TAXABLE

- SALES TAX EXEMPTIONS

- KANSAS EXEMPTION CERTIFICATES

- REGISTRATION AND TAX NUMBERS

- RETAILER RESPONSIBILITIES

- DETERMINING THE FILING FREQUENCY

- KANSAS CUSTOMER SERVICE CENTER

- RETAILERS SALES TAX

- COMPENSATING USE TAX

- ADDITIONAL INFORMATION

- OTHER KANSAS TAXES

- RESALES EXEMPTION CERTIFICATE (ST-28A)

- MULTI-JURISDICTION EXEMPTION CERTIFICATE (ST-28M)

- TAXPAYER ASSISTANCE

KANSAS SALES TAX

Kansas is one of 45 states plus the District of Columbia* that levy a sales and the companion compensating use tax. The Kansas Retailers’ Sales Tax was enacted in 1937 at the rate of 2%, increasing over the years to the current state rate of 6.50%.

| 2.00% (1937) | 4.00% (1986) | 5.30% (2002) | 6.50% (2015) |

| 2.50% (1958) | 4.25% (1989) | 6.30% (2010) | |

| 3.00% (1965) | 4.90% (1992) | 6.15% (2013) |

* Alaska, Delaware, Montana, New Hampshire, and Oregon do not have a general sales or use tax. Purchases made in these states by Kansas consumers are automatically subject to Kansas use tax. See Kansas Use Taxes, herein.

LOCAL SALES TAX

In addition to the state sales tax, counties and cities in Kansas have the option of imposing a local sales tax. Before imposing a local sales tax, the governing body of the city or county must receive the approval of a majority of its voters. Cities may levy a local sales tax in five-hundredth percent increments (0.05%). Counties may levy a local sales tax in one-fourth percent increments (0.25%, 0.50%, etc.). Cities are authorized to impose a maximum sales tax rate of 3% (2% general and 1% special). Counties are authorized to impose a maximum 1% general sales tax rate. Legislative action is required for more than 1%.

Although these are local taxes, the law requires them to be administered by the Kansas Department of Revenue. The local rate(s) are added to the state rate to arrive at the total sales tax percentage collected by Kansas retailers from their customers. Local tax applies whenever a state tax is due if the tax situs for the sale is in a county or city with a local tax with a few exceptions.

EXAMPLE: The combined state and local sales tax rate in Garden City is 8.95%; the 6.50% state, a 1.45% Finney County tax, plus a 1% Garden City tax. The combined state and local sales tax rate for Finney County, outside the city limits of Garden City, is 7.95%; the 6.5% state, plus a 1.45% Finney County tax.

IMPORTANT: The combined tax rate that is charged is based on the destination of the goods or service. In other words, the rate in effect where the customer takes delivery of the merchandise or makes first use of a taxable service. See Local Sales Tax Application Destination Based Sourcing, herein.

Sales Tax Jurisdictions

To assist you in collecting and reporting the correct rate of sales tax, the Department of Revenue has developed Pub. KS-1700, Sales Tax Jurisdictions, which contains an alphabetical listing of all Kansas county and city sales tax rates, their jurisdiction codes for tax reporting, and the effective dates of the tax. The Department of Revenue provides updates throughout the year of any quarterly tax rate changes, as well as additional jurisdictions imposing a local sales tax. This information is available on our website, as is a sales tax rate locator where tax rates can be obtained by entering an address or zip code.

DISTRIBUTION OF REVENUE

All state, county, and city sales tax collections are remitted to the Department of Revenue and the department deposits the state sales tax revenues into the state general fund, with a portion designated for the state highway fund. The Department of Revenue then distributes local sales tax revenues to the counties and cities in which they were collected using the information provided by retailers on their tax filings.

SALES TAX and YOUR BUSINESS

Sales tax is paid by the final consumer of taxable goods or services to you, the retailer. A Kansas retailer is responsible for collecting sales tax from its customers on taxable transactions. In collecting sales tax, you are acting as an agent or partner with the Department of Revenue. A retailer holds the tax in trust for the state, and then sends it to the Department of Revenue on a regular basis using an electronic filing method.

Paying sales tax is the duty of your customers — it is unlawful for a customer to refuse to pay the sales tax due on a taxable transaction. When added to the purchase price of taxable goods or services, the sales tax is a debt from the consumer to the retailer, and as such, is recoverable by the retailer from the customer in the same manner as any other debt.

SALES THAT ARE TAXABLE

Kansas sales tax generally applies to three types of transactions.- The retail sale, rental, or lease of tangible personal property, including the sale or furnishing of utilities within the state of Kansas;

- Charges for labor services to install, apply, repair, service, alter, or maintain tangible personal property; and

- The sale of admissions to places providing amusement, entertainment or recreation services, including admissions to state, county, district, and local fairs.

If you are engaged in any of these activities, you must collect sales tax from your customers. What follows is a detailed discussion of each of these general categories with examples. The law (K.S.A.) or regulation (K.A.R.) on which it is based is also included.

RETAIL SALE, RENTAL OR LEASE OF TANGIBLE PERSONAL PROPERTY

To be taxable, the sale must first be a retail sale; defined as follows.

RETAIL SALE — an exchange of tangible personal property (goods, wares, merchandise, products and commodities) for money or other consideration to the final user or consumer occurring within the legal boundaries of the state of Kansas.

Sales for resale (purchase of inventory), and sales to wholesalers and others who are not the final consumer are not taxed. However, these sales must be accompanied by an exemption certificate — see Exemption Certificates herein. Kansas sales tax also does not apply to goods shipped to another state. See Out-of-State Sales, herein.

Tangible personal property — any item to which you can readily attach a monetary value (food, clothing, furniture, vehicles, computers, equipment, books, tapes, etc.).

Tangible personal property has a physical presence, it can be owned or leased and can be moved. Tangible personal property is different from intangible personal property (stocks and bonds) or real property (land or buildings). Other types of taxable sales of tangible personal property listed in Kansas sales tax law follow. Exceptions are noted.

CONSTRUCTION MATERIALS.

Materials and supplies sold to contractors, sub-contractors, or repairmen for use by them in construction projects are subject to sales tax. Exception: Materials purchased by a contractor using a special project exemption number issued by the Kansas Department of Revenue or its authorized agent are exempt.

COIN-OPERATED DEVICES.

Sales made from any coin-operated device, dispensing or providing goods, amusement, or services are taxable. Examples include any type of vending machine, and car washes, and video or arcade game machines. Exception: Coin-operated laundry services (washers or dryers) are exempt from sales tax. Laundry detergent, bleach, etc. purchased from a vending machine are taxable.

COMPUTER SOFTWARE.

Sales of prewritten computer software and the services of modifying, altering, updating, or maintaining computer software are subject to sales tax. Computer equipment and hardware are also taxable. Sales and/or services relating to customized software are exempt. See EDU-71R Information Guide on our website.

MEALS AND DRINKS.

Meals or drinks sold to the public at any restaurant, private club, drinking establishment, catered event, café, diner, dining car, hotel, etc. are taxable. Drinks containing alcoholic liquor are subject to the Liquor Drink Tax rather than sales tax. Cereal Malt Beverage license holders (3.2% beer) do not collect the Liquor Drink Tax; instead, they collect Kansas Retailers’ Sales Tax on their drink sales. If selling other goods and services other than alcoholic and cereal malt beverages, the business must register for and collect Retailers’ Sales Tax.

Effective April 1, 2019 CMB permit holders will be allowed to sell beer not more than 6% alcohol by volume in addition to CMB. These CMB permit holders will collect the applicable state and local sales tax on the sale of both CMB and beer. Retail liquor stores that sell beer will continue to collect the 8% liquor enforcement tax on those sales of beer. Other goods or services sold by a retail liquor store on their licensed premises (excluding the sale of lottery tickets) will be subject to state and local sales tax which includes the sale of cereal malt beverage. For additional information see NOTICE 18-04.

For more information on the sale of meals and drinks consult Pub. KS-1540, Kansas Business Taxes For Hotels, Motels and Restaurants. Exception: Free meals furnished to employees of public eating places are not taxed if the employee’s work is related to the furnishing or sale of such meals. Reduced cost employee meals are subject to tax based on the reduced price.

PREPAID TELEPHONE CARDS.

Sales of prepaid telephone calling cards or authorization numbers and the recharge of the card or number are taxable. Exception: There is no sales tax on the 911 service fee imposed on prepaid telephone cards.

MOTOR VEHICLES AND TRAILERS.

The sale or exchange of motor vehicles is a taxable transaction. When you buy a car, truck, or other vehicle from a registered dealer, you must pay the sales tax to the dealer. When you buy a motor vehicle or trailer from an individual, you must pay the sales tax to the county treasurer upon registration. The rate of tax is determined using the sourcing rules for motor vehicles outlined herein. For more information on the sale of motor vehicles see Pub. KS-1526, Sales and Use Tax for Motor Vehicle Transactions and How EDU-31A Kansas Motor Vehicle Dealers Should Charge Sales Tax on Vehicle Sales. Exceptions: The following transactions are not taxed.

- Motor Vehicles, semi trailers, pole trailers or aircraft sold to a bona fide resident of another state, provided the vehicle is not registered in Kansas and is removed from Kansas within 10 days of the purchase;

- Motor vehicles or trailers transferred by a person to a corporation solely in exchange for stock or securities in that corporation (the original sale is taxable — the transfer to the corporation is not);

- Motor vehicles or trailers transferred by one corporation to another when all of the assets of such corporation are transferred to the other corporation;

- Rolling stock used by a common carrier in interstate commerce;

- Motor vehicles or trailers sold by an immediate family member to another immediate family member. Immediate family members are lineal ascendants or descendants and their spouses.

UTILITIES.

Included in the definition of tangible personal property are utilities. The following are subject to the state and local sales tax (exceptions noted):

Cable, community antennae, and other subscriber radio and television services.

Digital Satellite TV Subscriptions. Exception: The subscription fee is subject to the state sales tax only – local taxes do not apply.

Electricity, gas, propane and heat. Exception: Agricultural and residential use of these utilities are exempt from state sales tax, but are subject to applicable local sales taxes in effect at the customer’s location.

Telephone and Telegraph Services, Intrastate, interstate or international telecommunications services and any ancillary services sourced to Kansas. Exceptions: Any interstate or international 800 or 900 service; any interstate or international private communication service; any value-added nonvoice data service; any telecommunication service to a provider of telecommunication services, including carrier access service; or any service or transaction defined in this section among entities classified as members of an affiliated group as provided by 26 USC 1986.

Telephone Answering Services, mobile phone services, beeper services, cellular phone services, and other similar services.

Rental or Lease of Property

Tangible personal property is taxable not only when it is sold at retail, but also when it is rented or leased. The sales tax is added to each rental or lease payment made, including “lease with option to buy” contracts and “rent to purchase” contracts.

EXAMPLE: A Pittsburg, Kansas office equipment company leases copiers for $150 per month. Added to each monthly invoice will be the state sales tax plus the local sales tax in effect where the leased copier is located.

Other examples of items commonly leased or rented that are taxable include: appliances; hotel and motel rooms (Rooms rented for 28 consecutive days or less may also be subject to a transient guest tax.); boats; motor vehicles (Vehicles rented for 28 consecutive days or less are also subject to a vehicle rental excise tax.); computers; movie videos/DVDs; equipment; tools; furniture; and trailers. Exceptions: Movies, films, and tapes rented to movie theaters are exempt since the sales tax is collected on the admission charge. Also, tangible personal property used as a dwelling (such as a mobile home) is exempt from sales tax when leased or rented for more than 28 consecutive days.

NOTE: Tangible personal property purchased for the purpose of leasing or renting, such as the purchase of cars (rental fleet) by a car rental agency, is exempt from sales and use taxes. This is considered to be a purchase of inventory for resale, and the rental agency would provide the seller with a completed ST-28A, Resale Exemption Certificate.

TAXABLE SERVICES

A service is work done for others as an occupation or business. Kansas sales tax applies to the services of installing, applying, altering, repairing, servicing, or maintaining tangible personal property.

Installing

Installation services include installing plumbing, wiring, cabinets, light bulbs and other fixtures in an office building, planting trees, shrubs or grass, or installing tires or parts on a vehicle.

EXAMPLE: A Colby, Kansas automotive repair shop installs a muffler on a New York resident’s automobile in Colby. The total bill (muffler and labor) is subject to the state and local sales tax in effect in Colby, Kansas.

Applying

This category of taxable services includes painting, wallpapering, applying fertilizer/weed killer, waxing floors, and resurfacing parking lots. All of these services involve the application of tangible personal property — the paint, wallpaper, fertilizer, weed killer, wax, or asphalt/gravel.

Altering

Services such as furniture refinishing, upholstery work, modifying or updating computer software, sewing, and alteration services change or alter the furniture, software, or clothing, and are taxable.

Repairing, Servicing, and Maintaining

Repair, service, and maintenance of tangible personal property includes these types of services:

- appliance repair or service

- car repair or service

- dry cleaning, pressing, dyeing & laundry services (dry cleaning and laundry services are also subject to the Dry Cleaning Environmental Surcharge)

- maintenance agreements

- pet grooming

- tool sharpening (saws, knives, etc.)

- warranties (including extended & optional)

- washing, waxing, or detailing vehicles

Following is a representative list of services that are NOT TAXABLE because they do not involve the installation, application, service, maintenance, or repair of tangible personal property:

| accounting | cleaning | legal services |

| architectural | consulting | mowing |

| broadcasting | engineering | snow removal |

| child care | excavating | towing/moving |

| chimney-sweeping | hair styling | trash hauling |

Exceptions for Residential and Original Construction:

Taxable services are exempt when performed in conjunction with the following.

- Original construction of a building or facility.

- Restoration, reconstruction, remodeling, or renovation of a residence.

- Addition of an entire room or floor to an existing building or facility.

- Completion of any unfinished portion of an existing building or facility for the first owner.

- Restoration, reconstruction, or replacement of a building, facility or utility structure damaged or destroyed by fire, flood, tornado, lightning, explosion, windstorm (80 mph or more), ice loading and attendant winds, terrorism, or earthquake. “Utility structure” means transmission and distribution lines owned by an independent transmission company or cooperative, the Kansas electric transmission authority or natural gas or electric public utility.

- Construction, reconstruction, restoration, replacement, or repair of a bridge or highway.

CAUTION: Many service professionals provide both taxable and nontaxable services. There are also other special rules that apply to contractors and the labor services industry not discussed here. Consult the Policy Information Library on our website for additional information about specific service situations.

The following sales tax guideline has been issued by the Department of Revenue and is available on our website.

ADMISSIONS

An admission or fee charged to any place providing amusement, entertainment, or recreation services is taxable. Taxable admissions include:

Tickets to a concert, sporting event, movie, circus, rodeo, or any other event where a ticket is required;

Admissions to a fair, amusement park, zoo, antique or craft show, club, or other facility charging an admission fee or cover charge;

Dues or Memberships that entitle someone to use a facility for recreation or entertainment, such as a health club, country club, or the Knights of Columbus;

Fees and charges for participation in sports, games, and other recreational activities.

Exceptions: The following admissions and fees have been granted a sales tax exemption.

- Admission to any cultural and historical event that occurs once every three years.

- Sales of tangible personal property (such as a button) which will admit the buyer to an annual event sponsored by a 501(c)(3) nonprofit organization.

- Fees and charges by Kansas political subdivisions for participation in sports, games and other recreational activities. This includes city baseball and softball leagues, or green fees or swimming pool fees at city or county owned facilities.

- Fees and charges by a 501(c)(3) youth recreation organization, exclusively providing services to persons 18 years of age or younger, for participation in sports. Examples include: youth basketball, baseball, football, softball, or soccer leagues.

- Entry fees and charges for participation in a special event or tournament sanctioned by a national sporting association to which spectators are charged an admission. Examples of entry fees exempt under this provision include: 1) American Bowling Conference (ABC) tournament; 2) Professional Golfers Association (PGA) tournament; 3) National Hot Rod Association (NHRA) race; and 4) Professional Rodeo Cowboys Association (PRCA) rodeo.

- Fees charged by nonprofit humanitarian service providers exempt from property tax for participation in sports, games, and other recreational activities. Qualifying nonprofit service providers include: the American Red Cross, Big Brothers & Big Sisters, Boy Scouts, Girl Scouts, YMCA, YWCA, community health centers, and local community organizations.

- Membership dues to military veterans organizations and their auxiliaries, such as the Veterans of Foreign Wars and the American Legion.

- Membership dues charged by a nonprofit 501(c)(3) organization whose sole purpose is to support a nonprofit zoo.

SALES TAX EXEMPTIONS

Included with the taxable transactions in the previous section were some of the exceptions, or exempt sales. Other lawful sales tax exemptions fall into three general categories. These are:

- buyers who are, and are not exempt,

- specific items that are exempt, and

- uses of an item which makes it exempt.

EXEMPT BUYERS

Direct purchases of goods or services by the following entities are exempt from sales tax (for a complete list see Pub. KS-1520, Kansas Exemption Certificates:

- The U.S. Government, its agencies and instrumentalities

- The state of Kansas and its political subdivisions, including school districts, counties, cities, port authorities, and groundwater management districts

- Elementary and secondary schools

- Noncommercial educational radio and TV stations

- Nonprofit blood, tissue, and organ banks

- Nonprofit educational institutions

- Nonprofit 501(c)(3)* historical societies

- Nonprofit hospitals

- Nonprofit 501(c)(3)* museums

- Nonprofit 501(c)(3)* primary care clinics/health centers

- Nonprofit 501(c)(3)* religious organizations

- Nonprofit 501(c)(3)* zoos

* The 501(c)(3) designation refers to an Internal Revenue Code section exempting certain organizations from income tax. There is NOT an automatic exemption from sales tax for non-profit organizations. They must apply for an exempt entity certificate.

Exception: When the state of Kansas or nonprofit hospital operates a taxable business (such as a public cafeteria or gift shop), or when a political subdivision sells or furnishes the utilities of electricity, gas, heat or water (except certain water retailers - see below), non-inventory items purchased for use in these taxable businesses are taxable to the otherwise exempt group.

To claim its exemption, the exempt buyer must complete and furnish the appropriate exemption certificate to the seller (see Kansas Exemption Certificates, herein). The sale must also be a direct purchase — billed directly to the exempt buyer and paid for by a check or voucher from the exempt buyer. Purchases made by agents or employees of an exempt buyer with their personal funds are taxable. Exception: Purchases of hotel rooms by U.S. government employees on official business are exempt, regardless of the method of payment.

Exempt Entity Identification Numbers.

To help retailers identify the exempt buyers discussed in this section, the Department of Revenue will assign an Exempt Entity Identification Number and issue a Tax-Exempt Entity Exemption Certificate to qualified exempt buyers. From that date, Kansas exempt entities claiming a sales or use tax exemption must provide this completed exemption certificate (which includes their tax exempt number) to the retailer. See Pub. KS-1520.

Other Exempt Buyers

Sales tax exemptions are also granted to the following entities. Where applicable, the exemption certificate designed for that particular exemption is noted.

Certain Nonprofit Medical Educational Organizations

The following 501(c)(3) organizations are exempt from paying sales tax when buying items for the listed uses, and also exempt from collecting sales tax when these items are sold by or on behalf of the exempt organization for the stated purposes. This exemption is for goods and merchandise only. These organizations must still pay or collect sales tax on taxable services and admissions.

- American Diabetes Association, Kansas Affiliate, Inc.

- American Heart Association, Kansas Affiliate, Inc.

- American Lung Association of Kansas, Inc.

- Kansas Alliance for the Mentally Ill, Inc. and Kansas Mental Illness Awareness Council

- Kansas Chapters of the Alzheimer’s Disease & Related Disorders Association, Inc.

- Kansas Chapters of the Parkinson’s Disease Association

- National Kidney Foundation of Kansas and Western Missouri

- HeartStrings Community Foundation

- Cystic Fibrosis Foundation, Heart of America Chapter

- Spina Bifida Association of Kansas

- CHWC, Inc.

- Cross-Lines Cooperative Council

- Dreams Work, Inc.

- KSDS, Inc.

- Lyme Association of Greater Kansas City, Inc.

- Dream Factory, Inc.

- Ottawa Suzuki Strings, Inc.

- International Association of Lions Clubs

- Johnson County Young Matrons, Inc.

- American Cancer Society, Inc.

- Community Services of Shawnee, Inc.

- Angel Babies Association

Certain Water Retailers

Public water suppliers who pay the Clean Drinking Water Fee are exempt on all purchases of property or services for that utility. See NOTICE 04-08.

Diplomatic Tax Exemption — Certain foreign missions and officials are entitled to a tax exemption based on reciprocal treaty agreements. Those entitled to tax exemption must present a Tax Exemption Card issued by the Office of Foreign Missions (OFM) of the U. S. Department of State. Details are in NOTICE 04-09.Domestic Violence Shelters

Property and services purchased by or on behalf of the domestic violence shelters that are member agencies of the Kansas coalition against sexual and domestic violence (KCSDV) are exempt.

Habitat For Humanity

This organization may buy the materials that will be incorporated into its housing projects without sales tax. The exemption applies only to housing materials. Habitat for Humanity must still pay sales tax on all of its other purchases of goods or taxable services.

Korean War Memorial

Property and services purchased by or on behalf of a 501(c)(3) nonprofit corporation organized to construct a Korean War Memorial are exempt from sales tax. The Department of Revenue has issued Project Exemption Certificates (PECs) to the qualifying entities.

Parent-Teacher Associations

A PTA or PTO is exempt from paying sales tax when buying goods and services. It is also exempt from collecting sales tax on its sales of tangible personal property, but must collect tax when selling taxable services or admissions.

Religious Organizations

All sales of tangible personal property and services purchased by a 501(c)(3) religious organization, and used exclusively for religious purposes, are exempt. Religious organizations also qualify to request a PEC so that materials purchased or furnished by a contractor to construct or remodel facilities for the religious organization are also exempt.

Rural Volunteer Fire-Fighters

Property or services purchased by or on behalf of rural volunteer fire-fighters and used exclusively by them in the performance of their duties and functions are exempt from sales tax.

Youth Development Programs

Sales of tangible personal property to a nonprofit organization for nonsectarian comprehensive multi-discipline youth development programs and activities, and all sales of tangible personal property by or on behalf of such organization are exempt from tax. Examples include: Boy Scout and Girl Scout Councils and Troops. Exception: Sales of taxable services and sales of property customarily used for human habitation (such as beds, chairs, bedding, and lamps) are taxable to a nonprofit youth development organization.

For a complete list of all tax exempt entities, see Pulication KS-1520.

BUYERS WHO ARE NOT EXEMPT

The previous list of exempt buyers contains a number of nonprofit organizations. A common misconception is that all nonprofit organizations are exempt from sales tax. A federal exemption issued under section 501(c) of the Internal Revenue Code applies ONLY to federal and state INCOME TAX, this exemption does not extend to sales tax. Groups and organizations that are NOT EXEMPT from paying Kansas sales tax include:

- alumni associations

- charitable and benevolent organizations

- clubs and professional associations

- labor unions

- athletic or sporting organizations

ITEMS EXEMPT FROM SALES TAX

Items used by these industries and groups are exempt from sales tax:

Aircraft sales, parts, and repair services for carriers in interstate or foreign commerce. Also sales of aircraft repair, modification and replacement parts and sales of services employed in the remanufacture, modification and repair of aircraft. See NOTICE 04-06.

Broadcasting equipment purchased by over-the-air free access radio and television stations to generate their broadcast signals.

Drill bits and explosives used in the exploration of oil and gas.

Drugs and pharmaceuticals sold to veterinarians.

Farm machinery and equipment. See also Pub. KS-1550, Kansas Sales and Use Tax for the Agricultural Industry.

NOTE: Work-site utility vehicles that are more than 800 pounds, and at least 48 inches wide with four nonhighway tires, a steering wheel and has bench or bucket seating for at least two people side by side, may be purchased exempt from sales tax when used exclusively in farming and ranching.

Also, precision farming equipment, purchased and installed on farm machinery and equipment, is exempt from sales tax.

Food sold to groups providing meals to the elderly and homebound, and food sold by a nonprofit 501(c)(3) organization under a food distribution program that sells the food below cost in exchange for community service and all sales of food products by or on behalf of any such contractor or organization for any such purpose.

Integrated production machinery and equipment.

Materials purchased by a community action group to repair or weatherize low-income housing.

Medical supplies and durable medical equipment purchased by a nonprofit skilled nursing home, including oxygen delivery and kidney dialysis equipment and enteral feeding systems.

Public health educational materials purchased by a nonprofit corporation for free distribution to the public.

Railroad parts, materials, and services for railroad rolling stock used in interstate or foreign commerce.

Rolling stock (trucks, buses, tractor-trailers, etc.), repair or replacement parts, and motor fuels purchased by ICC carriers.

Warehouse machinery & equipment, racking systems.

An exemption certificate must be completed for these sales to be exempt. A detailed description of purchases qualifying for exemption is a part of each exemption certificate.

Other Exempt Items

The following items are exempt from sales tax in Kansas and do not require an exemption certificate:

- Food stamp purchases

- Child Nutrition Act (WIC program) purchases

- Lottery tickets

- Prescription drugs and insulin

- Orthopedic appliances

- Prosthetic Devices and Mobility Enhancing Equipment

purchased by an individual for whom it was prescribed in

writing by a licensed physician, chiropractor, optometrist,

dentist, or podiatrist is not taxed [K.S.A. 79-3606(r)]. Exempt

devices and mobility enhancing equipment include canes,

chairlifts, crutches, eyeglasses, orthodontic braces, prosthetic

limbs and braces, wheelchairs, and accessories attached to

motor vehicles, such as wheelchair lifts or specialized hand

or foot controls, oxygen delivery, kidney dialysis equipment

and enteral feeding systems. Repair and replacement parts

for the exempt equipment are also exempt if you have the

original prescription order on file. NOTE: The labor services

to install mobility enhancing equipment is taxable.

NOTE: The Prosthetic Devices and Mobility Enhancing Equipment exemption does not apply to hot tubs, whirlpools, motor vehicles, or personal property which when installed becomes a fixture to real property. - Repair and replacement parts for hearing aids, including the batteries, when sold by a person licensed in the practice of dispensing and fitting hearing aids pursuant to K.S.A. 74-5808 are exempt. See NOTICE 04-05 on our website. The labor services of repairing hearing aids when repaired by a person licensed in the practice of dispensing and fitting hearing aids pursuant to the provisions of K.S.A. 74-5808, are also exempt from Kansas sales tax.

USES THAT ARE EXEMPT

Other items are exempt from sales tax because of how they are used.

Agricultural Animals

Sales of agricultural animals, including fowl (i.e., cattle, chickens, hogs, ostriches, sheep, etc.); and aquatic animals and plants are exempt when used in:

- agriculture or aquaculture

- the production of food for human consumption;

- the production of animal, dairy, poultry, or aquatic plant and animal products, fiber, or fur;

- the production of offspring for the above purposes.

Animals that are not used for agricultural purposes (i.e., pets, show horses, etc.) are taxable.

Agricultural Soil Erosion Prevention

Seeds, tree seedlings, chemicals, and services purchased and used for the purpose of producing plants to prevent soil erosion on land devoted to agricultural use are exempt from sales tax.

Propane for Agricultural Use

Propane used for an agricultural purpose is exempt from sales tax. Examples include propane to power farm implements or to provide heat for brooder or farrowing houses. Propane used for a recreational purpose, such as RVs and barbecue grills, is taxable.

Consumed in Production (ST-28C)

Items that are essential and are depleted or dissipated within one year may be purchased without tax when they are consumed in the:

- production, manufacture, processing, mining, drilling, refining or compounding of tangible personal property,

- treatment of by-products or wastes of any the above processes,

- providing of taxable services,

- irrigation of crops,

- storage or processing of grain.

Examples include utilities to power manufacturing machinery, or fertilizers and insecticides used in the production of food.

Ingredient or Component Part (ST-28D)

Items that become a part of a finished product to be sold to the final consumer are exempt as an ingredient or component part. Some examples include, but are not limited to:

- oil paints, watercolors, and canvas used to produce a piece of artwork for resale;

- paper and ink for publishing newspapers and magazines;

- containers, labels, shipping cases, twine, and wrapping paper which are not returned to the manufacturer;

- paper bags, drinking straws, and paper plates used in food sales; and

- feed for commercial livestock.

As a general rule, if the item leaves with the product and is not returned for reuse by the manufacturer or retailer, it is an ingredient part.

The “ingredient and component part” and “consumed in production” exemptions apply to many business types. More information on these exemptions can be found in Pub. KS-1520, available on our website.

NOTE: Contractors are considered to be the final consumers of their materials and therefore may not use the consumed in production or ingredient or part exemption to purchase job materials.

Resale Exemption (ST-28A)

When buying your inventory from a wholesaler or another retailer, you will use a ST-28A Resale Exemption Certificate, or the PR-78SSTa Streamlined Sales and Use Tax Agreement Certificate of Exemption (PR-78SSTA) (Kansas).

A resale exemption certificate has two requirements: 1) the items purchased must be for resale in the usual course of the buyer’s business; and 2) the buyer must have a Kansas sales tax account number, except in drop shipment situations.

OTHER SPECIAL SITUATIONS

Exempt Construction Projects

Materials and labor services sold to a buyer holding a special Project Exemption Certificate issued by the Department of Revenue or its authorized agent are exempt from tax. Most of the exempt buyers listed on pages 6 and 7 qualify to obtain a project exemption for most projects. A project exemption may also be issued to a business that qualifies for economic development incentives.

Fuels

Gasoline, diesel fuels, gasohol, alcohol fuels and other similar combustible fuels are generally subject to the Kansas Motor Fuel tax (herein). However, these fuels are subject to sales tax when the motor fuel tax does not apply, such as dyed diesel fuel for non-highway purposes. Other fuels such as aviation fuel, jet fuel, kerosene, and propane are subject to sales or use tax unless their use or purpose qualifies for an exemption. For example, propane for agricultural use is exempt, but propane for an RV is taxed.

Isolated or Occasional Sales

Sales tax is NOT collected when tangible personal property or taxable services are sold at an “isolated or occasional” sale. Isolated or occasional sales are as follows.

1) Infrequent sales of a nonrecurring nature made by a person not engaged in the business of selling tangible personal property. To qualify, the seller shall not;

a. hold more than two selling events per calendar year, and the aggregate number of selling days for one or both events shall not exceed 7 calendar days; or

b. hold itself out as being engaged in the business of selling property or services of the type being sold.

Sales that usually meet these criteria are estate sales, farm sales, garage sales, and some auctions.

2) A religious organization may acquire (purchase) tangible personal property for the purpose of holding a nonrecurring selling event (typically as a fund-raiser) without paying sales tax on its purchase of the tangible personal property or collecting sales tax when the tangible personal property is sold.

3) Any sale by a bank, savings and loan institution, credit union or any finance company licensed under the provisions of the Kansas uniform consumer credit code, tangible personal property which has been repossessed by any such entity.

4) Sale of business assets in conjunction with the sale or termination of a business (other than the sale of the business’s inventory, motor vehicles or trailers) if the sale is made in a complete and bona fide liquidation of a business of the seller.

a. The term “business” means a separate place of business subject to registration under the Kansas retailers’ sales tax act.

b. The term “a complete and bona fide liquidation” means the sale of all assets of the business conducted over a period of not more than 30 days beginning on the date of the first sale of assets, or as approved by the Director of Taxation.

5) Auctions may be isolated or occasional sales if:

a. The auction takes place at a location OTHER THAN one that is regularly used to conduct auctions.

b. The goods being auctioned have not been purchased for resale.

c. The goods being auctioned have not been consigned for sale by more than one party in addition to the principal seller at the auction.

If some of the goods being auctioned satisfy the above requirements but others goods do not, the sale of every item at the auction shall be subject to sales tax.

EXAMPLE: A Kansas resident has an estate sale before moving into a retirement home. The agent will not charge tax at the estate sale since it is an isolated sale of property that is owned by one household.

EXAMPLE: An auctioneer conducts an auction of the inventory and fixtures of a clothing store. Sale of the inventory is subject to sales tax because the owner was engaged in the retail clothing business. The sale of the fixtures is not subject to tax as an isolated sale of property on which tax has already been paid. Exception: The isolated or occasional sale of a motor vehicle or trailer is taxable — see page 4.

Mobile or Manufactured Homes

When a new mobile or manufactured home is sold, only 60% of the total selling price is subject to sales tax [K.S.A. 79-3606(ff)]. In this situation, trade-in allowances (described on page 14) are not allowed in determining the sales tax base. The rate of tax charged on these home sales is determined by the retailer’s location (see page 12).

The sale of a used mobile or manufactured home (other than the original retail sale) is exempt under K.S.A. 79- 3606(bb).

KANSAS EXEMPTION CERTIFICATES

USING EXEMPTION CERTIFICATES

Exemption certificates are an important part of sales and use tax record keeping, but are often found lacking by our auditors. The information in this section will help you properly complete and accept exemption certificates. Pub. KS-1520, Kansas Exemption Certificates, is also a helpful resource.

This publication contains all the exemption certificates currently in use and provides detailed information about each exemption. The publication is available on our website.

Before accepting any certificate, carefully read the exemption statement and the accompanying explanation and instructions. Most certificates contain a restatement of the Kansas law (K.S.A. – Kansas Statutes Annotated), or regulation (K.A.R. – Kansas Administrative Regulations) authorizing the exemption. If your customer or the purchase does not fit the definition in the certificate or the exempt examples given, the sale is probably not exempt.The Kansas Exempt Entity Identification Number and Certificate are designed to help retailers and exempt customers complete the certificate process, not to replace it. See NOTICE 04-10 on our website.

Completing an Exemption Certificate

Follow these three rules when completing any exemption certificate.

1) Print or type all information (except for the authorized signature, if handwritten). The information on the certificate must be legible both to you and to our auditors. Do not print a signature on paper forms, although it is often helpful to print or type the name below the signature. (A signature is not required on an electronic exemption certificate.)

2) Fill in all the blanks. A certificate is complete only when all the information is provided. If there is a blank on the form, it must be filled in. Addresses must include the street or PO Box, city, state, and zip code.

When the certificate requires a tax registration number, be sure your customer provides it. An exemption certificate is not complete unless the customer supplies the proper registration number(s). A seller may lawfully require a copy of the buyer’s sales tax certificate of registration as a condition of honoring the ST-28A Resale Exemption Certificate. [K.A.R. 92-19-25b]

3) Give specific descriptions. Be as precise as possible when describing the property or services purchased. You may use an itemized list, refer to an itemized invoice number, or at the very least provide a general description of the items. When describing a business activity, include the principal product(s) sold or manufactured.

Blanket Exemption Certificates

If you make recurring exempt sales of the same type to the same purchaser, it is not necessary to have an exemption certificate for each transaction. You may accept a blanket exemption certificate to cover future sales. ST-28A and ST-28M may be used as a blanket certificate.

IMPORTANT: When you use a blanket exemption certificate for your regular exempt customers, ask them to verify or renew this document every year. Renewing yearly will help guarantee that the exempt customer’s information (i.e., exact business name and location, tax account number, etc.) remains accurate and up-to-date.

CAUTION: When you use blanket exemption certificates, you should segregate any taxable purchases from that vendor and pay for them separately. Each buyer signs the exemption certificate acknowledging responsibility for payment of the tax if:

“...the tangible personal property or service is used other than as stated ... or for any other purpose that is not exempt from sales or compensating tax...”

Record Keeping

Keep all sales tax records, including exemption certificates and copies of tax exemption cards (Kansas or diplomatic), for your current year of business and at least three prior years.

Penalties for Misuse

A buyer who issues an exemption certificate in order to unlawfully avoid payment of the tax for business or personal gain is guilty of a misdemeanor, and upon conviction may be fined up to $1,000 or imprisoned for up to a year, or both. When a buyer is found to have used a Resale Exemption Certificate (ST-28A) to avoid payment of the tax, the director may also increase any penalty due on the tax by $250 or 10 times the tax due, whichever is greater, for each transaction where the misuse of a Resale Exemption Certificate occurred.

CONTRACTOR DECISION MATRIX

To assist contractors in determining the tax treatment of their labor services and materials for a particular job, the Department of Revenue has developed this decision matrix. By answering the questions about the type of contract in the order presented you will easily be able to determine the sales tax treatment of the materials and labor services.

1)Is this project being performed for a public water supplier paying the Clean Drinking Water Fee?

Yes. Public water suppliers that pay this fee are exempt from sales tax on all property or services purchased directly or indirectly by them to construct, operate or maintain the water district. These water suppliers must provide you a copy of their Clean Drinking Water Fee Exemption Letter from the Kansas Department of Revenue and with the exemption certificate (ST-28EE) for the indirect purchases (materials, subcontractor labor) made by you on their behalf. Kansas political subdivisions paying the Clean Drinking Water Fee may use a Project Exemption Certificate (PEC) in lieu of Form ST-28EE.

No. Go to Question 2.

2)Is this a project covered by a PEC?

Yes. All parts of the project are exempt –materials and labor, including materials and/or labor provided by all subcontractors. The customerwill provide the general contractor with a copy of the numbered PEC, who will in turn provide to all the other contractors on the project.Each will give a copy to their vendors to validate the exemption from sales tax on materials and/or labor provided for the project.

No. Go to Question 3.

REGISTRATION AND TAXNUMBERS

WHO MUST REGISTER

If you sell goods, admissions, or provide taxable services you must be registered with the Department of Revenue to collect sales tax from your customers on behalf of the state and, where applicable, the city and/or county. This requirement applies whether your business is a sole proprietorship, partnership, corporation, or any other organizational type, including nonprofit, religious, governmental or educational groups.

If you are making retail sales or providing taxable services in Kansas, you must register and collect the tax. Out-of-state retailers that have either physical or economic nexus in Kansas must register. Retailers from other states selling goods in Kansas at temporary locations (i.e., craft or trade shows, fairs, etc.) or non-resident contractors performing labor services in Kansas, must also obtain a permanent registration number.

Marketplace Facilitators

A marketplace facilitator is required to begin collecting and remitting tax on sales in excess of the $100,000 threshold as soon as they cross the threshold. In other words, a marketplace facilitator is required to register, collect, and remit tax on the next transaction after meeting or exceeding the threshold.

Because each marketplace facilitator will meet or exceed the threshold at a different time, each marketplace facilitator will establish its own date for when registration, collection, and remittance requirements begin. It is important to note that, regardless of when registration and remittance of tax actually occur, responsibility for collecting tax begins with the next transaction after meeting or exceeding the threshold. By way of example, if a marketplace facilitator’s first transaction is $105,000, responsibility for collecting tax does not begin until the next transaction, regardless of the amount of that transaction. If a marketplace facilitator has multiple transactions that total $99,950 and then has a $100 transaction, responsibility for collecting tax does not begin until the next transaction. And if a marketplace facilitator has multiple transactions that total $99,950 and then has a $100,000 transaction, responsibility for collecting tax still does not begin until the next transaction.

A marketplace facilitator should register with the Department not later than thirty (30) days after their sales for the calendar year exceed $100,000. At the time of registration, the type of registration (i.e. sales tax or retailers’ compensating use,) will be determined. For purposes of registration, the type of tax to be collected and remitted depends upon the location of the marketplace facilitator. A marketplace facilitator located in Kansas (i.e. physical nexus) will register for, collect, and remit Kansas retailers’ sales tax. A marketplace facilitator located outside of Kansas (i.e. economic nexus) will collect and remit Kansas retailers’ compensating use tax.

A marketplace facilitator that makes both direct and facilitated sales may choose to report sales separately or on one return. If sales will be reported separately it will be necessary for the marketplace facilitator to have two accounts; one for its sales and one for facilitated sales. In addition, each marketplace facilitator’s reporting and remittance schedule will be determined, based on the total amount of tax collected.

This is the content for Layout P Tag

As an alternative to registering directly with the Department, marketplace facilitators may register through the Streamlined Sales Tax Registration System. Additional information is available through their website at https://www.streamlinedsalestax.org/for-businesses/sales-tax-registration-sstrs.

For additional information, see Notice 21-14 Marketplace Facilitators-Products.NONRESIDENT CONTRACTORS

The Nonresident Contractors Act was passed to help ensure payment of all Kansas taxes by nonresident contractors and nonresident subcontractors working in Kansas. Contractor includes any individual, partnership, firm, corporation, or other association of persons engaged in the business of construction, alteration, repairing, or dismantling of real or personal property.

Nonresident contractors and nonresident sub-contractors must register with the Director of Taxation for each contract performed in Kansas when the total contract price or compensation received is more than $10,000. This registration requirement is waived if the nonresident contractor/subcontractor is a foreign corporation authorized to do business in Kansas by the Kansas Secretary of State.

To register, a nonresident contractor or subcontractor must complete the Nonresident Contractor section of the CR-16 Kansas Business Tax Application which is available through the Kansas Customer Service Center and post any required bond. This is in addition to the Kansas sales and withholding tax registrations required when working in Kansas.

REMOTE SELLERS

A “remote seller” is required to begin collecting and remitting tax on sales in excess of the $100,000 threshold as soon as they cross the threshold. In other words, a “remote seller” is required to register, collect, and remit tax on the next transaction after meeting or exceeding the threshold.

Because each “remote seller” will meet or exceed the threshold at a different time, each “remote seller” will establish their own date for when registration, collection, and remittance requirements begin. It is important to note that, regardless of when registration and remittance of tax actually occur, responsibility for collecting tax begins with the next transaction after meeting or exceeding the threshold. By way of example, if a “remote seller’s” first transaction is $105,000, responsibility for collecting tax does not begin until the next transaction, regardless of the amount of that transaction. If a “remote seller” has multiple transactions within a calendar year that total $99,950 and then has a $100 transaction, responsibility for collecting tax does not begin until after the $100 transaction. And if a “remote seller” has multiple transactions within a calendar year that total $99,950 and then has a $100,000 transaction, responsibility for collecting tax still does not begin until after the $100,000 transaction.

A “remote seller” should register with the Department for retailers’ compensating use tax not later than thirty (30) days after their sales for the calendar year exceed $100,000. At the time of registration each “remote seller’s” reporting and remittance schedule will be determined, based on the total amount of tax collected.

As an alternative to registering directly with the Department, “remote sellers” may register through the Streamlined Sales Tax Registration System. Additional information is available through their website at: https://www.streamlinedsalestax.org/for-businesses/sales-tax-registration-sstrs.

For additional information, see Notice 21-17 Remote Sellers.

HOW TO REGISTER

To apply for a tax number or to register for Kansas Retailers’ Sales Tax, visit ksrevenue.gov and sign in to the KDOR Customer Service Center. After you complete the application you will receive a confirmation number for your registration and account number(s). For complete instructions about the application process, obtain Pub. KS-1216, Business Tax Application, from our website.

If you prefer, you may apply in person – KDOR provides same-day registration service. An owner, partner, or a principal officer (president, vice-president, or secretary-treasurer) may bring the completed application to our assistance center. We will process the application, assign a registration number, and issue a Certificate of Registration if you have no outstanding tax liability.

Another option is to mail or fax your completed business tax application to our office 3-4 weeks prior to making retail sales. This will ensure that your tax account number and registration certificate are issued before your first tax payment is due.

SALES TAX ACCOUNT NUMBERS

Once your application is processed, your business is assigned a sales tax account number. Your sales tax account number has three distinct parts:

| 1 | 2 | 3 |

|---|---|---|

| 004 | 123456789F | 01 |

1 - Tax Type: Each tax type administered by the Department of Revenue has been assigned a number. The “004” is the number assigned to Retailers’ Sales Tax and appears on your registration certificate.

2 - Account Number = EIN (Employer Identification Number): The number is your federal EIN, followed by the letter “F.” The nine-digit EIN is issued by the Internal Revenue Service to identify employers and businesses.

If you are not required to have an EIN, the Department of Revenue will create an account number for you. These account numbers begin with a “K” (or an “A” if registering online with the Kansas Business Center) followed by eight numbers and the “F.”

3 - Numerical Suffix: The two-digit code at the end of the number is for Department of Revenue use. Generally it is “01” and denotes either the number of locations or the number of registrations under this EIN, “K”, or “A” number.

A common misconception is that your sales tax number is also a “tax-exempt” number. You must complete an exemption certificate when buying your inventory or claiming another exemption. Although your sales tax number is required on exemption certificates used to purchase inventory and other exempt items, the primary purpose of this number is to identify your business for collecting and reporting the sales tax.

Be sure to write your tax account number on all correspondence sent to the Department of Revenue.

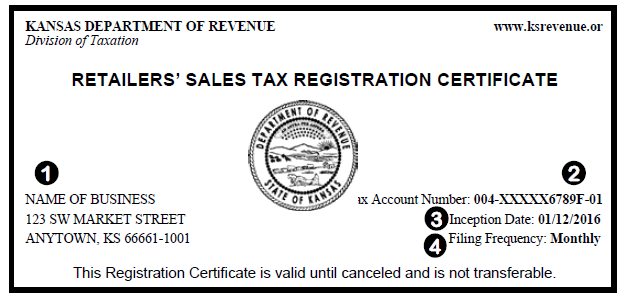

YOUR REGISTRATION CERTIFICATE

After a tax account number has been assigned, a sales tax registration certificate is issued to you. When you receive it, check it for accuracy and report any corrections to the Department of Revenue immediately. The following is a sample sales tax registration certificate.

1 - Business Name and Address: Name and physical location for this registration number. If you do not have a fixed business location, your mailing address is used.

2 - Tax Account Number: The tax-type and your EIN or “K” or “A” number assigned by the Kansas Department of Revenue to record your account information. This number is partially “masked” to safeguard your EIN from public view.

3 - Inception Date: Date retail sales began at this location or anticipated starting date as indicated on your business tax application.

4 - Filing Frequency: How often you are required to file your Kansas sales tax returns. Your filing frequency is determined by the amount of sales tax collected in a year using the chart on page 16.

How to Display and Use Your Certificate

Your registration certificate must be displayed in a “conspicuous location” in your business to let your customers know you are duly registered to collect and remit the taxes you are charging them. Many businesses place it in a display case or frame near their cash register. If you are registered for more than one tax, display them together. You must have a registration certificate at all times. If it is lost or destroyed, request a duplicate from the Department of Revenue.

If you do not have a permanent fixed business location, carry your registration certificate with you. Many retailers traveling from site to site laminate their certificate to protect it during travel. Your certificate should be available at each temporary sales location to present should a local or state official request proof of registration.

You may copy the certificate. Many suppliers will request a copy of your registration to verify your sales tax number on an exemption certificate.

RETAILER RESPONSIBILITIES

THE CARDINAL RULE

Kansas retailers are responsible for collecting the full amount of sales tax due on each sale to the final user or consumer. Kansas retailers should follow this cardinal rule:

All retail sales of goods and enumerated services are considered taxable unless specifically exempt.

Therefore, for every sale of merchandise or taxable services in Kansas, the sales receipt, invoice, or bill MUST either show that the total amount of sales tax due was collected, or be accompanied by a completed exemption certificate.

Follow this rule to avoid the expense of having to pay sales tax on items you sold without charging the tax or obtaining a completed exemption certificate.

COLLECTING TAX FROM YOUR CUSTOMERS

There are two acceptable ways to collect sales tax from your customers. The sales tax must either be: separately stated as a line item on an invoice, or included in the price of the item.

The most common method is to separately state the tax due on the invoice, bill, receipt, or other evidence of the transaction as shown in the examples that follow. If the tax is a line item, it must be clearly stated to the public as sales tax, and there must be a separate line on the invoice or receipt for the sales tax.

If the tax is included in the price, it must be clearly stated to the public that the price includes all applicable sales taxes. This method is often used by contractors or when it is not practical to add the tax at the point of sale, such as vending machine sales and sales of concessions where a large volume of sales must be made quickly.

CAUTION: When sales tax is included in the price, you MUST compute the total sales without tax before reporting it as “Gross Sales” when you file. See page 16, Line 1 – Gross Sales.

IMPORTANT: It is illegal for a retailer to advertise to the public or any consumer –directly or indirectly that the sales/ use tax or any part of the tax will be paid or absorbed by the retailer; sales/use tax is not a part of the price to the consumer; or, all or part of the sales/use tax will be refunded when it is added to the price [K.S.A. 79-3605].

NOTE: Amounts collected as sales tax must be remitted to the state. If too much tax is collected, it must either be refunded to the customer or remitted to the state.

SALES TAX RECORDS

It is most important to keep neat, thorough, and adequate records of all aspects of your business operation. Keeping good records will enable you to accurately complete your sales and use tax returns, your business and personal income tax returns, and determine the overall profitability of your business. There is no prescribed format for sales tax records. They may be maintained on a computer or kept in a notebook.

However, the content of your sales tax records is prescribed by law. Retailers must “keep records and books of all such sales, together with invoices, bills of lading, sales records, copies of bills of sale and other pertinent papers and documents...” [K.S.A. 79-3609]

Whether maintained electronically or on paper, your sales tax records must contain the following documents and information. [K.A.R. 92-19-4b]

- Gross receipts from the sale, rental, or lease of tangible personal property in the state of Kansas, including any services that are a part of the sale or lease, regardless of whether the receipts are considered to be taxable;

- all deductions allowed by law and claimed when you filed (See — Deductions on page 16);

- the purchase price of all tangible personal property purchased for sale, consumption, or lease in the state of Kansas (the cost of your inventory, equipment, and fixtures);

- all exemption certificates; and

- a true and complete inventory taken yearly. You must keep these records for the current year of business and at least three prior years. Some records, such as the purchase price of equipment and fixtures, must be kept longer for federal tax purposes. Your sales tax records must be available for, and are subject to, inspection by the Director of Taxation or authorized representative (auditor) at all times during normal business hours.

EXEMPTION CERTIFICATES

An exemption certificate is a document that shows why sales tax was not charged on an otherwise taxable sale of goods or services. It allows you to purchase your inventory, ingredient parts, and certain consumables without tax, and authorizes you to sell taxable items to exempt customers without collecting tax. Most of the exemptions discussed on pages 6 through 9 require an exemption certificate.

For a sale to be exempt, an exemption certificate must be furnished or completed by the buyer, and kept by the seller with other sales tax records. Do not send exemption certificates to the Department of Revenue; they are an integral part of your sales tax records subject to inspection by the Department of Revenue. When the seller timely obtains an accurately completed exemption certificate from the buyer and keeps it on file as part of their records, the seller is relieved from collecting the tax due on that sale.

You should obtain an exemption certificate before billing the customer or delivering the property. Retailers are responsible for obtaining a completed exemption certificate even though the purchaser may strike the tax from the bill or claim to be exempt only after receiving the merchandise. If you are unable to get a completed exemption certificate from a customer, the sale is considered taxable and you will be liable for the tax. In an audit situation, you have 120 days from date of notice to secure a completed exemption certificate from a customer. [K.S.A. 79-3609]

Additional information about completing Kansas exemption certificates is on page 9. For more details about how to properly use exemption certificates as a buyer or seller, and exemption certificates currently in use, obtain Pub. KS-1520.

DO NOT accept a copy of a customer’s sales tax registration certificate instead of an exemption certificate. The registration certificate shows the buyer is a retailer — it does not certify the purchase is exempt from tax.

LOCAL SALES TAX APPLICATION ON DESTINATION BASED SOURCING

Kansas participates in the Streamlined Sales Tax Project (SSTP). One area of uniformity among the states is in “sourcing” – that is, which local sales tax rate is due.

General Destination-Based Sourcing Rules

Kansas is a destination-based sourcing state. Under the sourcing rules, the rate of sales tax due on instate sales will be the combined state and local sales tax rate in effect where the customer takes delivery/possession of the purchased item(s). The seller collects the sales tax rate in effect at the seller’s place of business for over-the-counter transactions.

If the item(s) is shipped or delivered to the purchaser, the seller will collect the combined sales tax rate in effect at the location where the purchaser received the item(s). This will be the location where the seller delivers the item(s) to the purchaser, or if the seller ships the item(s), it will be the customer’s shipping address.

If the shipping address is not known to the seller, then it is the sales tax rate in effect at the purchaser’s address as maintained by the seller in the normal course of business. If the seller’s records do not contain an address for the buyer, then the seller should source the sale to the address of the buyer shown on the buyer’s payment instrument. If there is no address on the payment instrument for the buyer, then the sale would be sourced to the seller’s location.

EXAMPLE: A customer enters Joe’s Hardware in Pittsburg, Kansas, makes a purchase and takes possession of the item at the store. The combined rate of sales tax due is the rate in effect at Pittsburg, Kansas.

EXAMPLE: A customer enters Joe’s Hardware in Pittsburg, Kansas, buys an item and asks the retailer to deliver it to him in Columbus, Kansas. Joe’s Hardware will charge the combined rate in effect at Columbus, Kansas (where the customer took delivery).

Gifts/Delivery to Another Address or Location

When the product is not received by the purchaser at the seller’s location and the purchaser has given the seller instructions to ship or deliver the product to a donee of the purchaser, then the sale is sourced to the donee’s address furnished by the purchaser.

EXAMPLE: A Russell, Kansas resident buys a computer from a Wichita business as a gift for a student attending college and requests that the business ship it to the student’s address in Hays. The student is the purchaser’s donee, so the local sales tax applicable at the donee’s address in Hays, applies.

Receipt by Shipping Company on Behalf of Buyer

Receipt by a shipping company on behalf of a purchaser is not considered received for purposes of the sourcing rules.

EXAMPLE: A Hutchinson, Kansas law firm orders office supplies from an office supply company in Overland Park and requests the company deliver its order to Jones Shipping Co., which the law firm has retained to deliver the order to its Hutchinson office. In this situation, receipt by Jones Shipping Co. is not considered receipt by the purchaser for purposes of applying the sourcing rules. Since the buyer did not receive the order at the seller’s location and the seller did not ship or deliver the order to the buyer or to a third party, the sale should be sourced to the address of the buyer shown on the seller’s business records.

Sourcing of Services

Destination-based sourcing rules applies to all retail sales of taxable services, as well as all sales of tangible personal property. This means that the sale of a taxable service is sourced or taxed based on the location where the purchaser of the services makes first use of those services (often the same location where services are performed).

EXAMPLE: A rural Jefferson County resident brings his car to a mechanic in Topeka for repairs. The car repairs are performed at the mechanic’s shop in Topeka, and the consumer picks the car up at the shop location. The mechanic will collect the sales tax rate in effect in Topeka on the repair charges. If the mechanic had performed the repairs at the consumer’s residence, then he would collect the sales tax rate in effect at the customer’s rural Jefferson County address.

EXAMPLE: The heating system goes out in a medical office in Mound City and a repairman is called to fix it. The repair charges will be sourced based on where the repairs were performed – the medical office’s location in Mound City.

Leases or Rentals of Tangible Personal Property

For leases or rentals of tangible personal property in which periodic payments are made, the first lease payment is sourced under the general “destination-based” sourcing rules, as described above. The payments after the first payment are sourced to the primary property location. For leases with only one payment, the sale is sourced under the general destination-based rules. (Motor vehicles, trailers, semi-trailers, or aircraft that do not qualify as transportation equipment do not follow these sourcing rules.)

EXAMPLE: A consumer enters an equipment rental business and rents a lawn mower for a day, picking up the mower at the business and paying for the mower at that time. The rental is sourced to the business premises, and the local sales tax in effect at that location applies.

EXAMPLE: A consumer rents a tent for a party in the consumer’s backyard. The rental business delivers the tent to the consumer. The rental is sourced to the consumer’s location, and the combined state and local sales tax in effect at that location applies.

EXAMPLE: A St. Francis resident enters into a one-year lease as lessee of computer equipment and rental payments are due monthly. The lessor’s business location is in Goodland. The consumer picks up the computer equipment from the lessor’s business in Goodland. This equipment will be located at the consumer’s residence in St. Francis during the term of the lease. Because the lessee first took possession of the computer equipment at the lessor’s business premises (Goodland), the first lease payment is subject to the sales tax rate in effect at Goodland. However, subsequent lease payments will be sourced to the consumer’s location of St. Francis. In contrast, if the lessor shipped the computer equipment to the consumer’s location, the first lease payment (as well as the subsequent lease payments) would have been sourced to the consumer’s location in St. Francis.

Sourcing for Transportation Equipment

In general, transportation equipment means equipment used to carry persons or property in interstate commerce, such as aircraft (including containers attached thereto), buses, trucks, railcars and railroad locomotives. The general destination-based sourcing rules apply to the retail sale, lease or rental of transportation equipment.

Sourcing for Electricity, Gas, Water or Heat

The utilities of electricity, gas, water and heat are taxed at the local (and state) rate in effect at the customer’s location. Under the sourcing rules, these utilities are taxed based on the customer’s location. Residential and agricultural use of the utilities (except water) are subject only to local tax – the state sales tax of 6.50% does not apply to utilities used for a residential or agricultural purpose. Water for residential and agricultural use is exempt from both state and local sales tax.

Telecommunications Sourcing Rules

Telecommunications service has its own sourcing rules. These rules are consistent with the federal Mobile Telecommunications Sourcing Act. This means that telecommunications sales are generally sourced to the customer’s billing address.

Exceptions to the Destination-Based Sourcing Rules

Destination-based sourcing does not apply to: sales of watercraft, mobile, modular and manufactured homes, motor vehicles, trailers, semitrailer, pole-trailers and aircraft (not qualifying as transportation equipment as previously defined).

Retail sales of motor vehicles by Kansas dealers are subject to sales tax on the gross receipts received by the dealer. The sales tax rate charged is the combined state and local (city, county and/or special jurisdiction) rate in effect at the dealer’s place of business.

EXAMPLE: A Valley Falls, KS resident buys a car from an Atchison, KS dealer. The sales tax is computed on the 8.75% tax rate in effect at the retailer’s business location – Atchison. Additionally, the Valley Falls resident will pay the 0.75% difference between the Atchison rate and the 9.5% Valley Falls rate, to the Jefferson County Treasurer at the time of vehicle registration.

- Leases or rentals of motor vehicles, trailers, semitrailers,

or aircraft (not qualifying as transportation

equipment as previously defined) when recurring periodic

payments are:

- involved, those payments are sourced to the primary property location, which is the address for the property provided by the lessee that is available to the lessor from the lessor’s business records. This should be the registered address for the vehicle. Intermittent use of the property at different locations will not alter the primary property location.

- not involved, the lease or rental payment is sourced according to general destination-based sourcing rules.

EXAMPLE: An Emporia resident, the lessee, leases a car from a Wichita car dealer, the lessor, for a term of 3 years, with monthly lease payments due. The payments are sourced to the primary property location, which is the address that the lessee furnishes to the lessor as the location of the vehicle (should be same as where vehicle is registered, the consumer’s Emporia address). The local sales tax in effect at the primary property location of the leased vehicle, Emporia, applies to each of the lease payments. The lessor will collect and remit the state and local sales tax in effect at Emporia on the lease payments. If, during the term of the lease, the lessee moves to Newton and registers the vehicle there, the payments due after the move will be sourced to Newton and the lessor will collect and remit the state and local sales tax in effect in Newton.

EXAMPLE: A Council Grove resident rents a trailer from a rental business in Manhattan and takes possession of it at the rental business location in Manhattan. The rental period is 45 days, for a lump sum rental payment of $250. The rental business will collect the 9.45% Manhattan (address of the business) rate of sales tax on the rental proceeds of $250. If the rental business delivered the trailer to the consumer’s Council Grove address, the rental business would collect the 9.2% combined tax rate in effect at Council Grove, instead of the local sales tax in effect in Manhattan.

UNIQUE SOURCING SITUATIONS

Special sourcing rules and procedures apply to the sale of a direct mailing and to the sale of computer software delivered electronically. This section explains these rules and the sourcing certificates used for these types of sales.

For a direct mailing to addresses in several locations, the purchaser of the mailing must provide the seller with information showing the multiple jurisdictions to which the mailing is to be delivered, or provide a ST-31 Direct Mail Sourcing Certificate, available from our website or a Direct Pay Permit which is issued by the Department of Revenue to large businesses that make annual purchases of at least $1 million of tangible personal property for business use and not for resale. Additionally, a Sales Tax Rate Locator is available on our website to access sales and use tax rates and jurisdiction codes for any location in Kansas. Simply enter a complete address.

EXAMPLE: A business located in Hays, KS purchases a direct mailing of advertising flyers from a printer located in Hutchinson, Kansas. The flyers are to be mailed from Hutchinson to the business’s customers at various locations.

SITUATION #1: The purchaser provides mailing addresses of its customers to the printer. The printer will bill the purchaser for sales taxes applicable to the destination of the mailing, using the addresses to which the flyers were mailed. If 500 flyers were mailed to Great Bend, the local sales tax would be due on the price of those 500 flyers at the rate in effect at Great Bend. If 200 more flyers were mailed to Larned, the local sales tax would be due on the price of those 200 flyers at the rate in effect at Larned.

SITUATION #2: Same SITUATION #1, except the purchasing business gives the printer a ST-31 Direct Mail Sourcing Certificate indicating the purchaser will assume the obligation to pay and remit the applicable tax on a direct pay basis. Having received a Form ST-31 from the purchaser, the printer is now relieved of the obligation to collect and remit sales tax on the direct mailing. The purchaser is then obligated to remit directly the sales taxes applicable to the mailing, based on the addresses where the mailing was delivered.

SITUATION #3: Same SITUATION #1, except the purchaser fails to provide to the printer a ST-31 Direct Mail Sourcing Certificate, the information showing the jurisdictions to which the direct mail is delivered, or a Direct Pay Permit. In this situation, the printer must bill the purchaser for state and local sales tax at the rate applicable to the location from which the flyers were shipped, Hutchinson, Kansas.

THE SALES TAX BASE

The sales amount to which sales tax is added is called the sales tax base. The law uses the term gross receipts.